Some Of Tax Accounting

Table of ContentsAccountant In Florida - TruthsThe Buzz on Accountant In FloridaTop Guidelines Of Open LlcTop Guidelines Of Tax AccountingThe Buzz on Tax Accounting

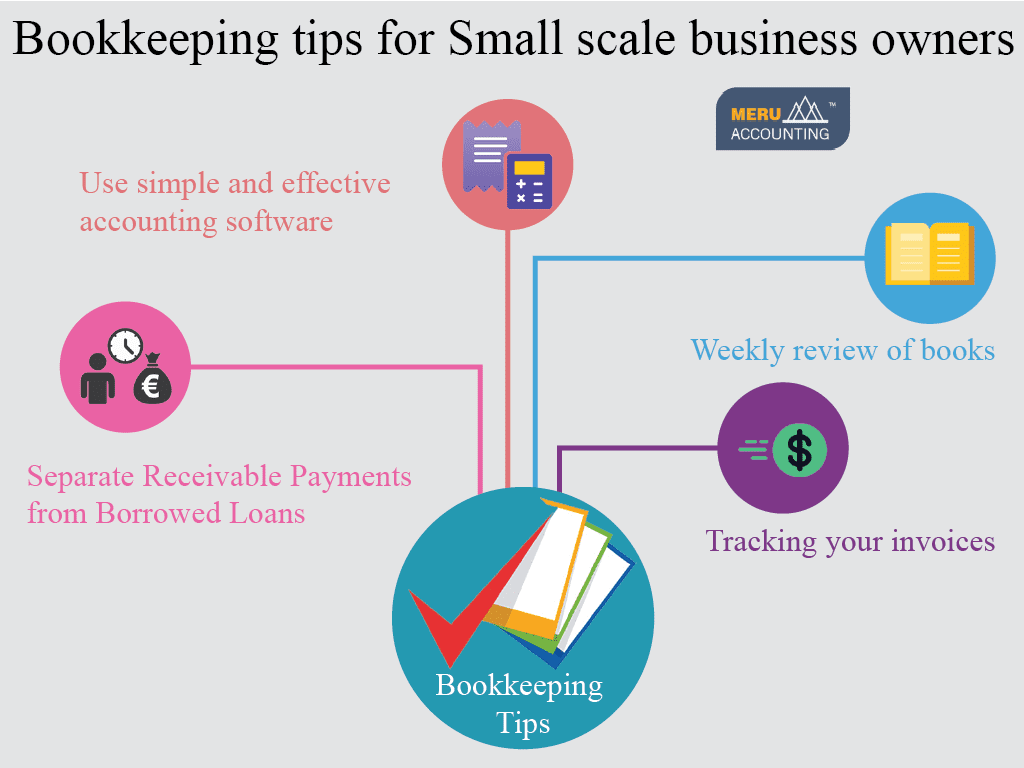

, are particularly made for company owners who simply desire to focus on invoicing their clients and tracking costs and also who give accessibility to the accounts to their expert bookkeeper or accountant to process the challenging accounting things every month. Many bookkeeping software application components discussed above give the ability to export different records to Excel for: simple manipulation as well as customizationproducing charts for fast reference or incorporating various elements of reporting from one period to the following Local business Bookkeeping Tips # 4 Keeping the documentation for all business transactions is a high top priority.

Many bookkeeping software application components discussed above give the ability to export different records to Excel for: simple manipulation as well as customizationproducing charts for fast reference or incorporating various elements of reporting from one period to the following Local business Bookkeeping Tips # 4 Keeping the documentation for all business transactions is a high top priority.Keeping them makes it possible for:- for any future inquiries that could stand out up, as well as (to an auditor or tax guy) of what took place. The majority of tax obligation divisions need businesses to keep the papers that back up their tax obligation claims for a minimum of 5 and commonly 7 years. These are records such as billings, invoices, wage records, etc (small business bookkeeping).

Some Of Small Business Bookkeeping

The only way to keep the records is to have a very well-organised declaring as well as archiving system. A box or basket filled with arbitrarily put documents makes it a lot harder to find what is required, and will certainly cause an unnecessary waste of time not to point out disappointment. There are three standard declaring alternatives readily available - i) the paper system, ii) the electronic system on your computer system's hard-drive, iii) on the internet documentation storage space.

It can be appealing to take the cash right away to buy supplies however this could create a mess in the accounting system. It can also show up as tax obligation evasion because the revenue is not being declared in the system.

Small Organization Bookkeeping Tips # 6 It's unexpected the number of company owners have no clue if what they are doing is working till it's far too late i. e. they all of a sudden discover themselves without any money and massive financial debts. You can prevent this situation by being pro-active regarding maintaining your bookkeeping system as much as date and also producing reports at least once a month.

The Definitive Guide for Accounting And Payroll Services

If you are going to own as well as run a company you can not disregard this element. Small Business Accounting Tips # 7 There is nothing even worse than having a task done by a person, like a plumbing technician, as well as after that waiting for months for an invoice.

It is extremely irritating needing to call a supplier to ask where the bill is. This shows up as dis-organisation to the customer, as well as from the plumbing technician's point of view can be detrimental to the organization cash money flow. As soon as a job is total, or at accounting and payroll services least by month's end, prepare as well as send the client invoices to ensure that the earnings can start rolling in, thus maintaining the financial institution equilibrium healthy and balanced and making it possible for settlements to distributors to be made when due.

Maintain it as well as be arranged concerning it! Certainly, this does not apply if business is operating on a cash basis without prolonging credit report to the customers because the cash money will certainly be coming in at the time of sale. Local Business Bookkeeping Tips # 8 If you, business owner, are also functioning as the office manager/ bookkeeper and also locating the bookkeeping also difficult or do not have sufficient time to do it, then contract out the entire lot.

Getting My Accountant Near Me To Work

It can take an expert accountant 2 to 4 hrs to refine one month's well worth of bank transactions, finalize a bank reconciliation, and create a collection of reports. You can outsource as little or as high as you want done. Below is a list of one of the most common jobs that belong of the accounting process.

Go into deals to the cash money book, to the correct account codes with the proper sales tax alternatives, Process bank reconciliations for the primary account, interest-bearing accounts, Prepare sales invoicesEnter acquisition billingsPrepare a lenders report and also upload set payments to the you can check here bank, Prepare a sales report as well as keep in contact with overdue debtors, Process pay-roll as well as established repayments to staff members, Refine payroll tax records to the tax obligation division and also established repayment, Process sales tax obligation returns and established up settlement to the tax obligation department, Prepare the monthly reportsRecommend you on the real state of your organization funds as well as provide you ideas on just how to boost capital.

You need to take an energetic interest in the financial aspects of your organization. Do not kick back and leave all of it to the accountant. It's unfair to them and also your company can wind up in alarming financial strife because of inexperience or scams by the accountant (it does happen). Open LLC.

See This Report about Accounting And Payroll Services

A single person can be accountable of receiving and also providing cash money with the petty money system, whilst an additional can do the month end reconciling of the cash money box - Payroll Services. Local Business Accounting Tips # 10 If you employ individuals in your service ensure you do the responsible point and also pay their wages or incomes in a timely manner.

A single person can be accountable of receiving and also providing cash money with the petty money system, whilst an additional can do the month end reconciling of the cash money box - Payroll Services. Local Business Accounting Tips # 10 If you employ individuals in your service ensure you do the responsible point and also pay their wages or incomes in a timely manner.With each pay run, make certain you establish aside financial savings to cover the pay-roll tax obligation from the employee's pay. Make sure you submit your pay-roll returns on time and make the payments on time.

You might try and also do the pay-roll manually yet there are lots of fairly priced pay-roll software application, desktop or online, which makes the task fast as well as very easy. Or outsource it to payroll specialists. Small Company Accounting Tips # 11 There are numerous new software application being presented to help little companies do much better, work much faster, be much more efficient, and also boost the bottom line and more.